PE

VC

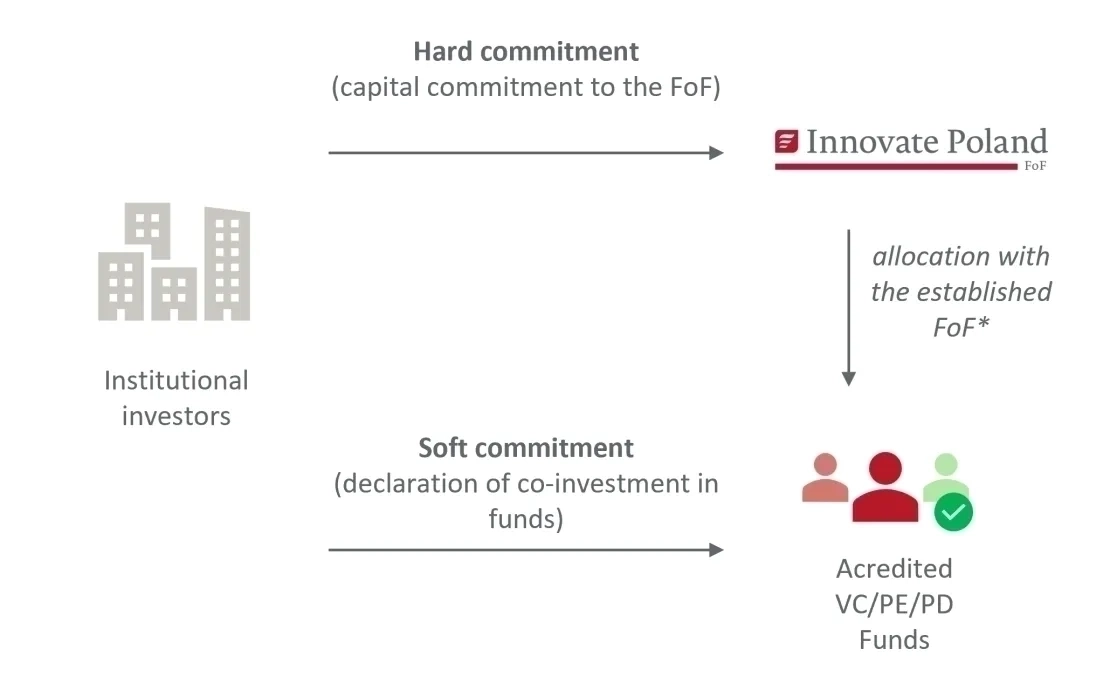

Innovate PL FoF

Fund Profile

VC, PE, PD

Investment Process

Continuous enrollment

Resources at disposal

0.8 bn PLN from FoF + 1.6 bn PLN in co-investments