PFR Biznest

Fund profile

seed, start-up ? PFR Biznest funds along with angel investors support companies at early stage

Assets under management

PLN 232m

Commitment

up to PLN 5m ? The maximum amount that can be invested by a fund established under PFR Biznest.

Private commitment

Yes, min. 40% ? Beyond private investors, General Partners commiit their own capital to a fund

Investment period

4 years

Investment process

cyclical calls ? You can file an offer whener the call is open.

About

PFR Biznest is a programme established to boost activity of business angels in Poland and encourage them to invest in young, innovative companies

PFR Biznest is addressed to teams managing Venture Capital which are planning to invest in early-stage companies (seed, pre-seed) together with private investors with appropriate capital and experience (Business Angels).

The program finances VC funds which invest together with Business Angels, taking over minority stakes in companies. Thanks to the activation of private capital and personal involvement of Business Angels, Biznest funds provide companies with so called smart money.

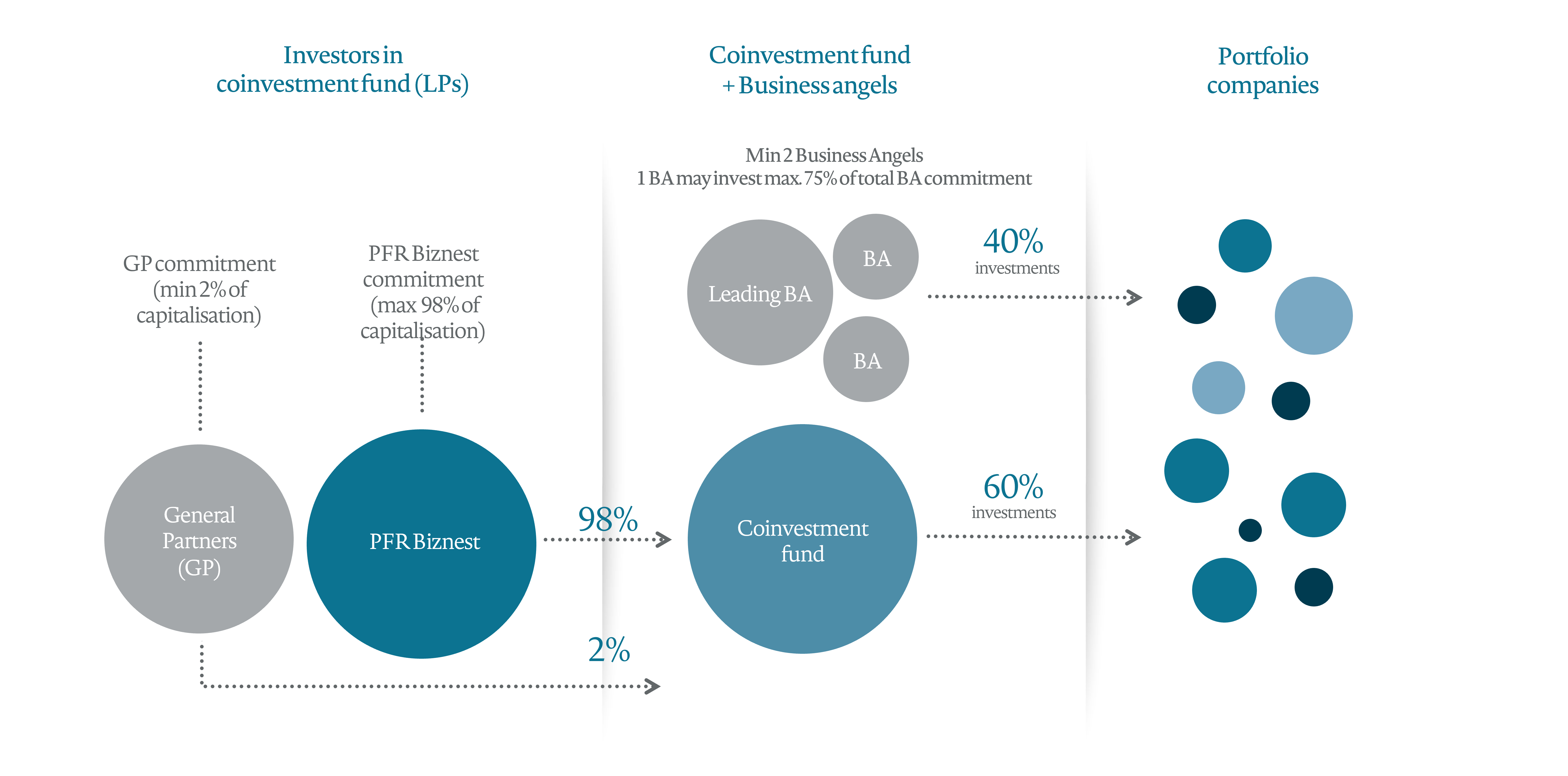

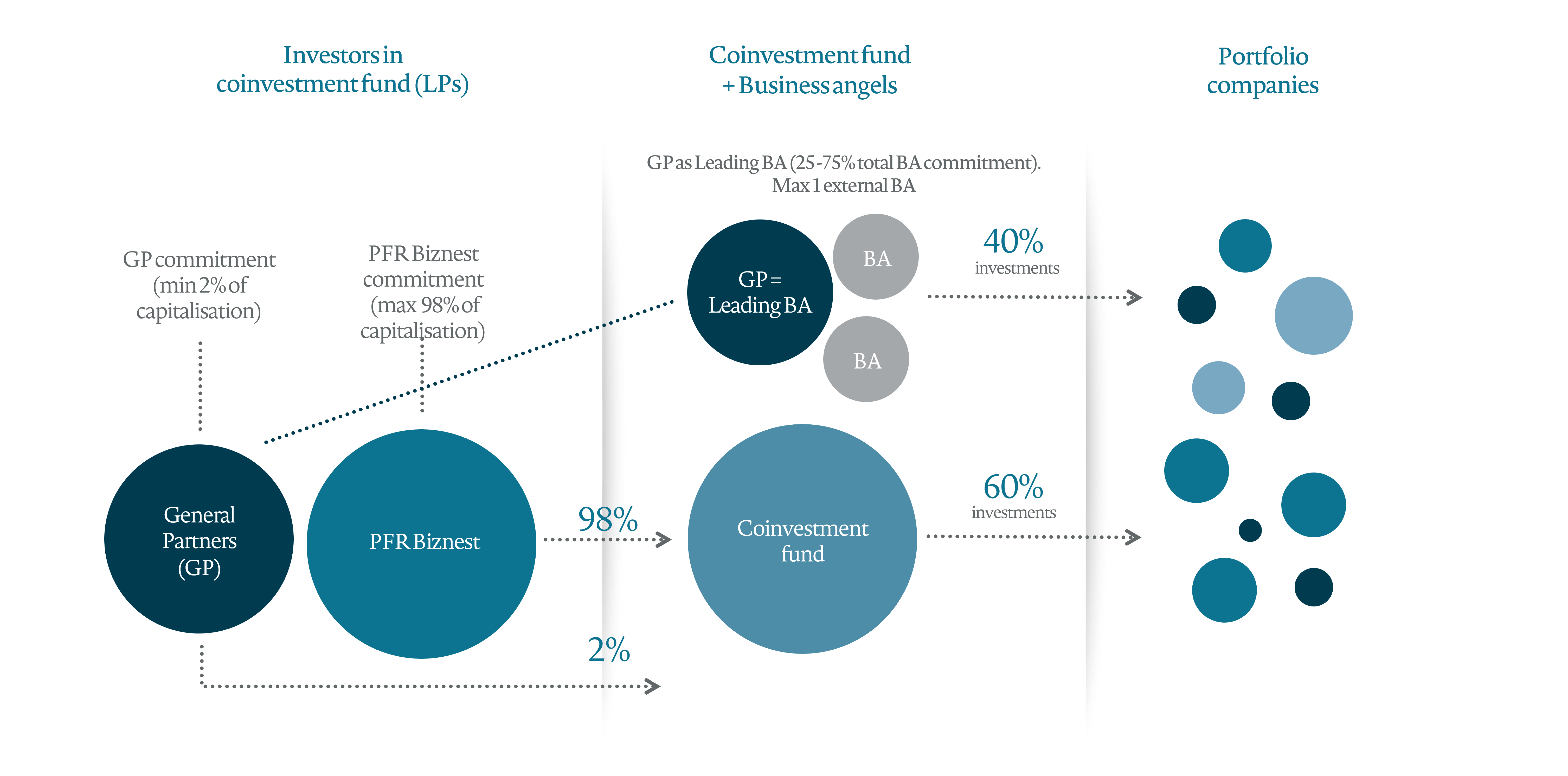

A fund may be established in two models:

- in the first one, one of partners must be a business angel who provides a considerable part of the capital in each of investments;

- in the other one, managing partners involve external business angels in an investment each time

The objective of PFR Biznest is to increase the scale of financing early-stage companies by activating private capital in the form of Business Angels’ investments, as well as:

- Building and development of the Business Angel ecosystem, including the Network of Business Angels and informal Business Angel groups;

- Establishing new managing teams, co-investing with Business Angels;

- Establishing the best standards in the Business Angels market, including supporting syndication processes.

Assets

Do you have any questions?

If you want to know more, please contact us.

Pozostałe produkty:

No results for chosen filters.

Try to clear filters or change search criteria.