Presentation from the first information meeting

[POLISH] Video of the first information meeting

seed, growth, expansion

PLN 373m

up to PLN 110m

Yes, min. 40% ? For CVC, private commitment should come from a corporation, beyond private investors, General Patners commit their own capital to a fund

5 years

cyclical calls ? You can file an offer whener the call is open

The PFR CVC programme is a Fund of Funds that will allocate PLN 370 million for investment in independent CVC funds. An additional PLN 250 million will be added to this budget by corporations. It is the first and only Polish and one of the few Funds of Funds in Europe providing financing in the CVC segment.

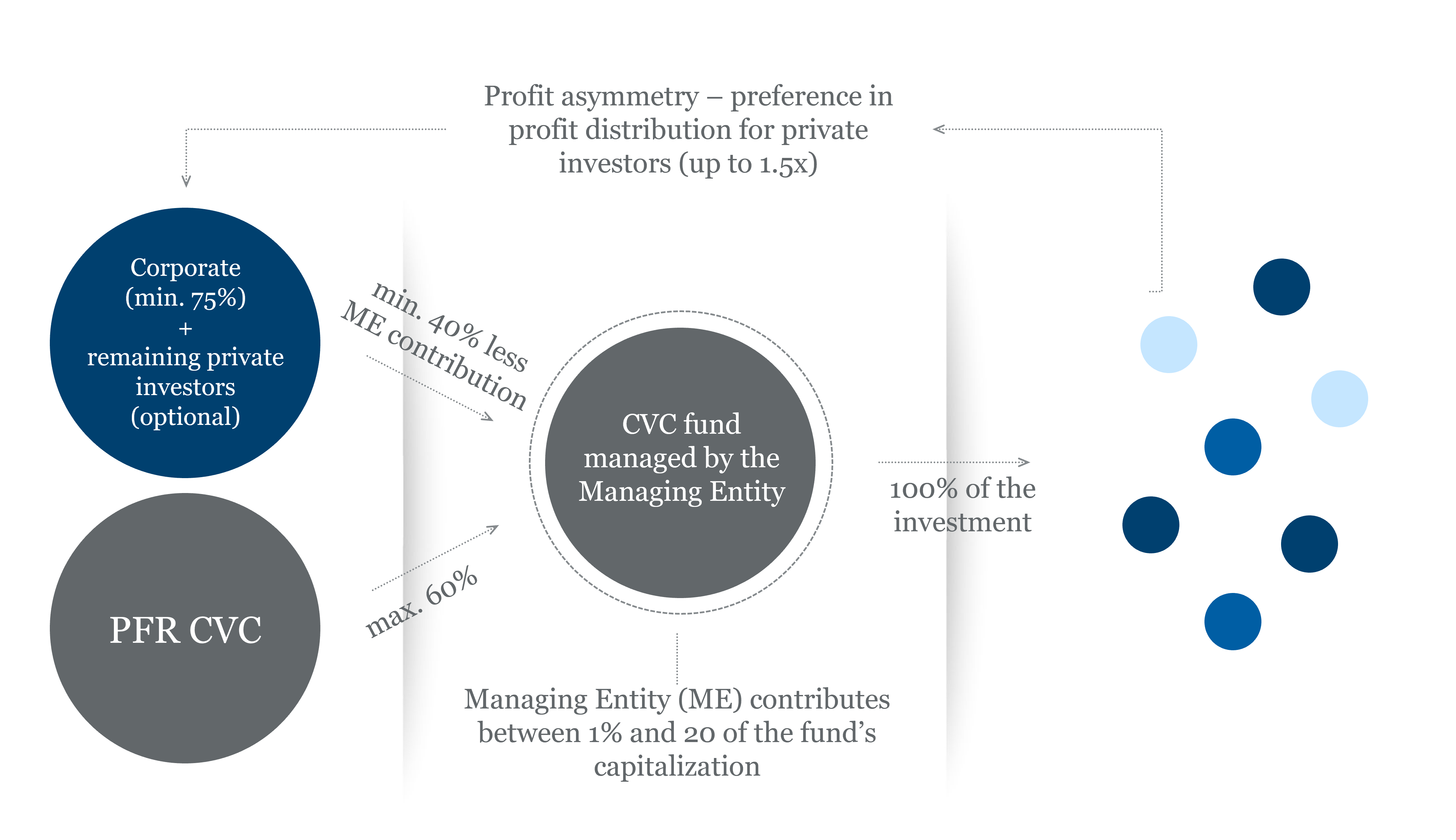

The new PFR CVC will allow two schemes for corporations to get involved. The first is the commitment model. The corporation then joins the fund directly and participates in each of its investments.

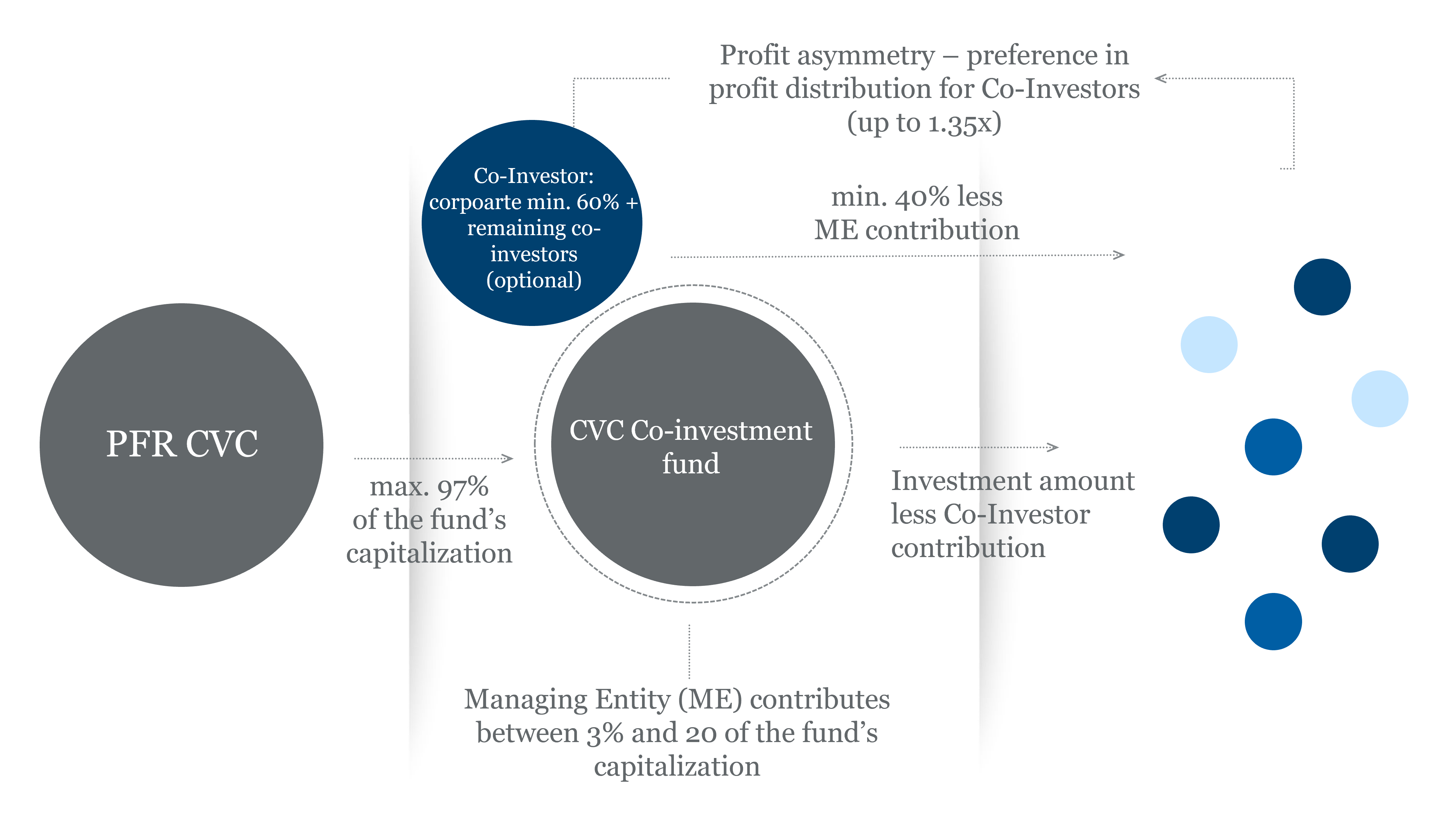

The second model, based on market expectations, allows the corporation to be involved in individual funudure investments (as a co-investor).

Presentations

Documentation

Notice of Call No. 3 for VC Funds – PFR CVC

Rules for the Submission and Selection of Tenders - PFR CVC

Appendix 1: Tender Identification Form

Appendix 2: Key Persons - Operating Team Members Verification Form

Appendix 2a: Verification Form for Key Persons

Appendix 2b: Verification Form for Operating Team member

Appendix 4: Financial Schedule

Appendix 5: List of potential investment projects

Appendix 6a: Private Investor’s Statement (Natural Person)

FAQ

Is there a limit to the concentration of investments with the same Co-Investor?

There is no concentration limit (number or amount) of Co-Investments made with a particular Co-Investor under the CVC Programme. The Fund will have the ability to make Co-Investments with a Co-Investor subject to the applicable requirements for Co-Investors as set out in the Term Sheet.

Can an agnostic (generalist) approach be pursued as part of an investment strategy?

Yes, the creation of a generalist fund is possible. It is not necessary to implement an investment strategy based on a specialist approach. The investment policy is determined by the Managing Entity. The investments made in Portfolio Companies must be in line with the investment policy of the VC Fund.

How funds from the Co-Investors will be treated?

Funds from Co-Investors will be subject to the same requirements under EU regulations as FENG funds from the CVC Programme. Disbursement of funds from Co-Investors will have to comply with the provisions of the Term Sheet.

How a Conflict of Interest should be managed when a Co-Investor is involved in the operating activities of a VC Fund or Portfolio Company?

The CVC Programme does not foresee the possibility for the Co-Investor to be involved in the operational activities of the VC Fund/management of the VC Fund. The Managing Entity must be independent of the Co-Investor. With regard to the Portfolio Company, the possibility of involvement of the (corporate) Co-Investor will be assessed with regard to the specific situation, as it would not be correct to give a clear - yes or no - answer to the question. Namely, the Co-Investor's involvement consisting, for example: in enabling the Portfolio Company to test the developed solution on the Co-Investor's infrastructure, would be permissible, provided the market nature of the transaction between the Co-Investor and the Portfolio Company. At the time of the investment, the Co-Investor must meet the prerequisites of independence from the Portfolio Company as indicated in the Term Sheet. The Co-Investor must not receive any remuneration from the Portfolio Company.

Assessment in the above area will be made on a case-by-case basis. The provision of smart money by the Co-Investor is a desirable element of the co-investment model (Model 2).

What is the limit of 15% of investments in companies based outside Poland based on? When will the verification be carried out?

The 15% investment limit refers to the basis of realised investments in Polish Portfolio Companies at acquisition prices. In order to make an investment in a foreign company, the amount of investment will be calculated on the level of invested funds in companies based in Poland. Verification of the limit will take place prior to making the investment in companies based outside Poland, i.e. prior to the meeting of the Fund's Investment Committee, at which the decision to make the investment will be made. The investment to be made must fall within the indicated limit, i.e. the participation in the VC Fund's portfolio of companies with their registered office outside Poland before and after the investment cannot exceed 15% of the realised investment at the purchase price.

Does the CVC Programme only involves VC investments or also buy-outs?

The CVC Programme provides for the possibility to acquire only minority interests in Portfolio Companies. Details are described in section 9 of the Term Sheet.

Does PFR Ventures participate in direct co-investments?

The programmes managed by PFR Ventures do not allow for direct co-investments alongside venture capital/private equity funds. PFR Ventures acts as a Public Investor in VC Funds.

Is this the only planned call under the Programme?

No, further calls are planned until the funds available in the Programme are exhausted. The next call is scheduled for 08.04-19.04.2024.

Does the capital structure of the Co-Investor affects the assessment of whether the investor is a Corporate or financial investor?

The CVC Programme provides for the possibility for a VC Fund to co-invest with an existing corporate venture capital fund that has private funds (Co-Investor). In this case, the Co-Investor will have to comply with the requirements set out in the Term Sheet. VC Funds established with PFR Ventures as Public Investor will not be able to act as Co-Investors.

Does PFR Ventures exclude the possibility of making Co-Investments with internally managed (by the corporation) CVC funds?

The CVC Programme provides for the possibility for a VC Fund to co-invest with an existing corporate venture capital fund that has private funds (Co-Investor). In this case, the Co-Investor will have to comply with the requirements set out in the Term Sheet. VC Funds established with PFR Ventures as Public Investor will not be able to act as Co-Investors.

Does the management fee should be deducted from the PFR CVC commitment amount?

The commitment amount of PFR CVC includes both contributions to the management fee and contributions to investments. In line with current market standards, the contribution (commitment) of all investors includes both the investment contribution and the management fee.

What are the requirements for the allocation, use and settlement of funds by Portfolio Companies?

Funds from PFR Ventures and funds contributed by Investors (Co-Investors - in the case of a VC fund established in the co-investment model) constituting contributions from the FENG programme are subject to certain expenditure rules. Namely - contributions from the FENG Programme may be incurred as eligible expenditure until the end of 2029. In addition, the funds should be disbursed in accordance with their intended purpose - i.e. for the management fee of the VC Fund and for investments made by the VC Fund.

The allocation of funds for investment should be specified in the business plan attached to the investment agreement. The Company is obliged to disburse the funds in accordance with the business plan, while the Managing Entity is obliged to monitor the implementation of the investment co-financed by the VC Fund. The disbursement should reflect the implementation of the VC Fund's investment strategy, in particular with regard to the focus of the disbursement on development and innovative activities or foreign expansion.

What is the mechanism for settling Profit Asymmetry with the Co-Investor? Is it possible for the VC Fund to invest without the participation of the Co-Investor in Model 2?

VC Fund operating under Model 2, cannot make investments without the participation of a private contribution by the Co-Investor in accordance with the Term Sheet, as at the level of the VC Fund only the Managing Entity and the Public Investor make their contributions to the VC Fund. The private contribution is provided at the level of each Co-Investment. The Profit Asymmetry for the Co-Investor is settled each time between the Co-Investor and the VC Fund at the level of the respective Co-Investment. Subsequently, after realisation of exits from all Portfolio Companies, a portfolio settlement at the level of the VC Fund takes place between the Managing Entity and the PFR CVC (Public Investor). The rules for the settlement of exit proceeds are described in section 21 of the Term Sheet.

Do the Offers with foreign Private Investors or Co-Investors will be additionally scored due to attracting capital to Poland?

The assessment of the additional value contributed by a Private Investor or Co-Investor is assessed each time in the context of the VC Fund’s investment strategy. The CVC Programme does not explicitly provide for additional scoring for submitting an Offer with Private Investors or Co-Investors from outside of Poland, however, if a positive impact of the presence of such investors in the Offer is identified, the CVC PFR reserves the possibility to award additional points in the evaluation of the Offer.

What is the maximum Profit Asymmetry for the Co-Investor?

In Model 2, the maximum Profit Asymmetry for the Co-Investor is derived from the proportion of the allocated Profit Asymmetry, management fee and Carried Interest for the Managing Entity from the Co-Investor set out in the co-investment agreement between the Managing Entity and the Co-Investor. The terms of the co-investment agreement should ensure the community of interest of the Managing Entity and the Co-Investor. The granting of the maximum Profit Asymmetry to a Co-Investor who simultaneously contributes more than the minimum required contribution under the CVC Programme, does not pay the management fee to the Managing Entity for the supervision of the Portfolio Company, as well as does not agree to pay Carried Interest from its Surplus, may mean that despite a successful exit, the Managing Entity will not achieve a positive rate of return. The terms and conditions for structuring the co-investment agreement to ensure that it provides the optimum level of the aforementioned parameters are at the discretion of the Managing Entity.

First edition of PFR NCBR CVC

See a summary of the first edition of programmes based on SGOP (Smart Growth Operational Programme) funds here. You will also find archived programme documentation, investment data and portfolio funds.

If you want to know more, please contact us.

No results for chosen filters.

Try to clear filters or change search criteria.

As part of provision of services by PFR Ventures and for strategic purposes, the www.pfrventures.pl site uses cookie files. Using the site without changing the cookie settings means that they will be saved on the user's end device. More information is provided in the Privacy Policy.