Raporty i ebooki

Publish date:

21 October 2025

Polish VC market outlook Q3 2025

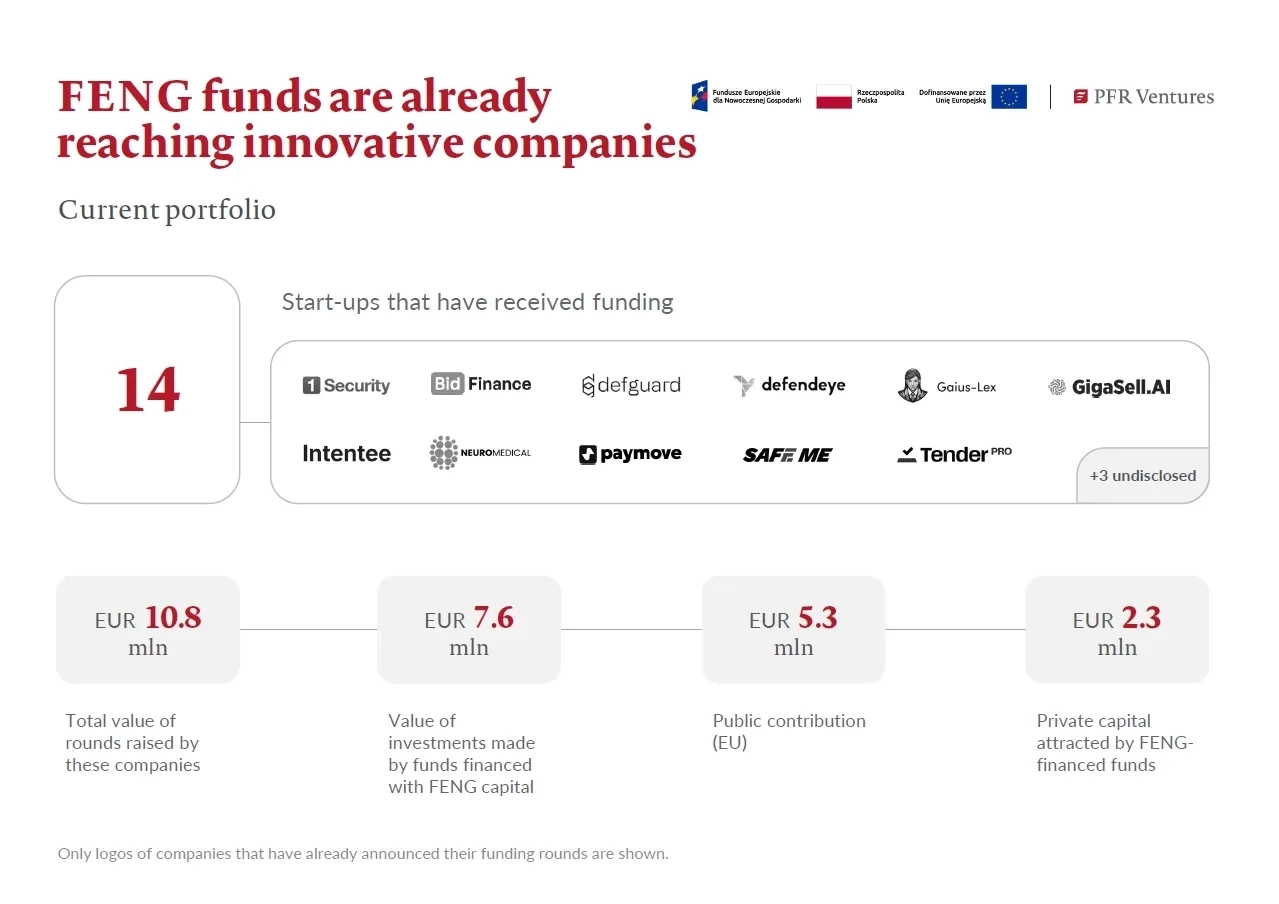

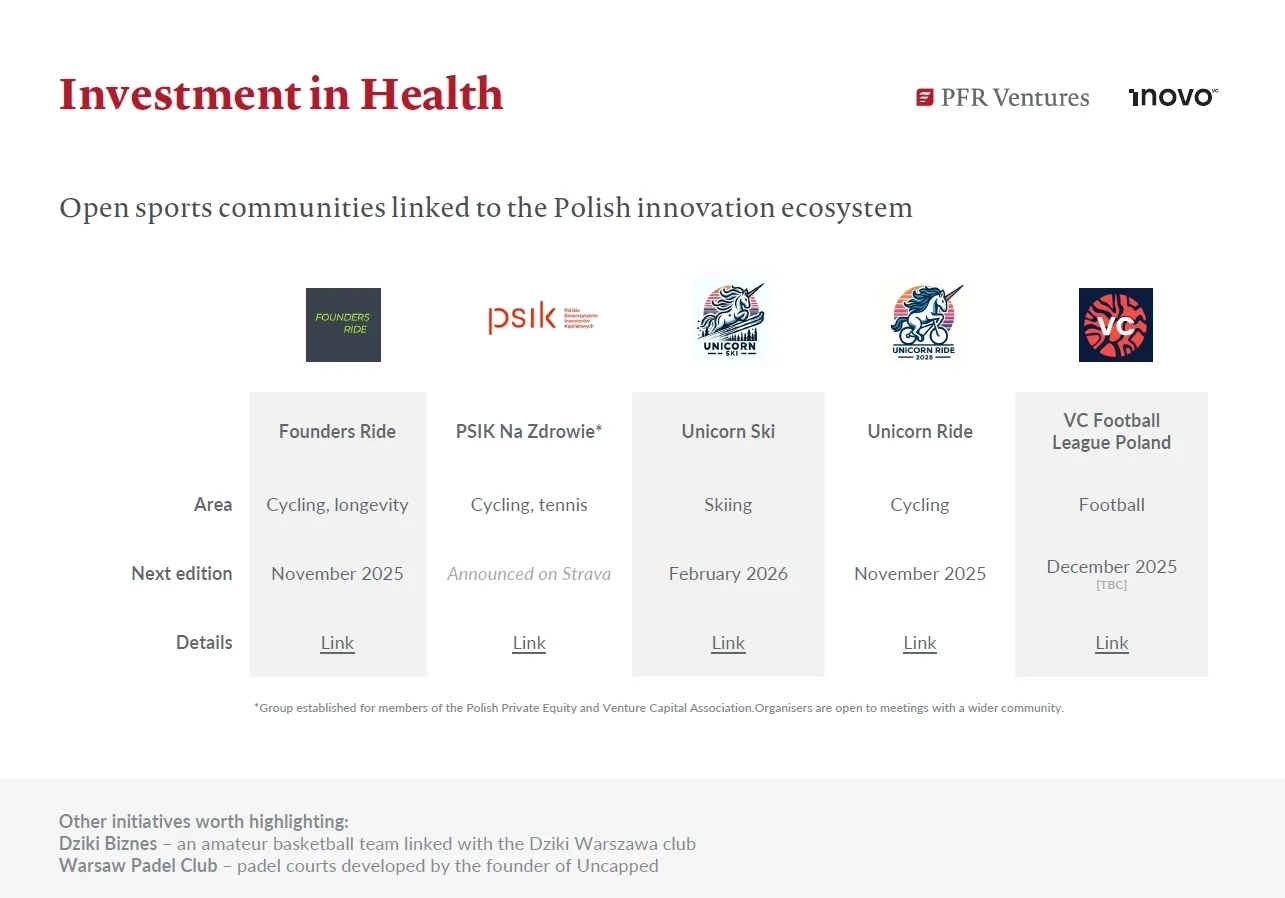

PFR Ventures and Inovo.vc have released a report on the Polish venture capital (VC) market for the third quarter of 2025. The findings reveal that 39 companies secured EU 109 million in funding from 45 investment funds.