Raporty i ebooki

Publish date:

05 August 2025

Polish VC market outlook Q2 2025

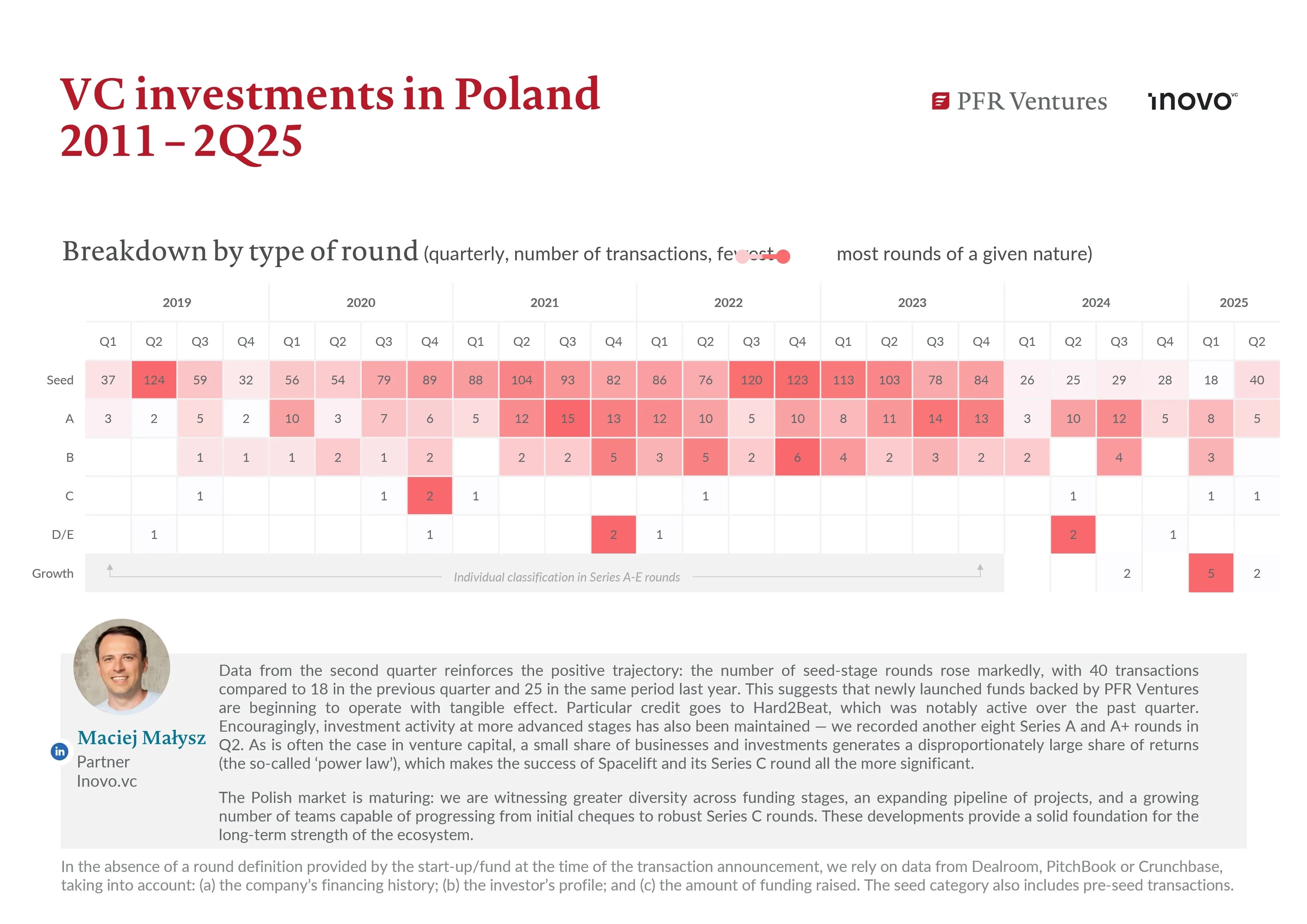

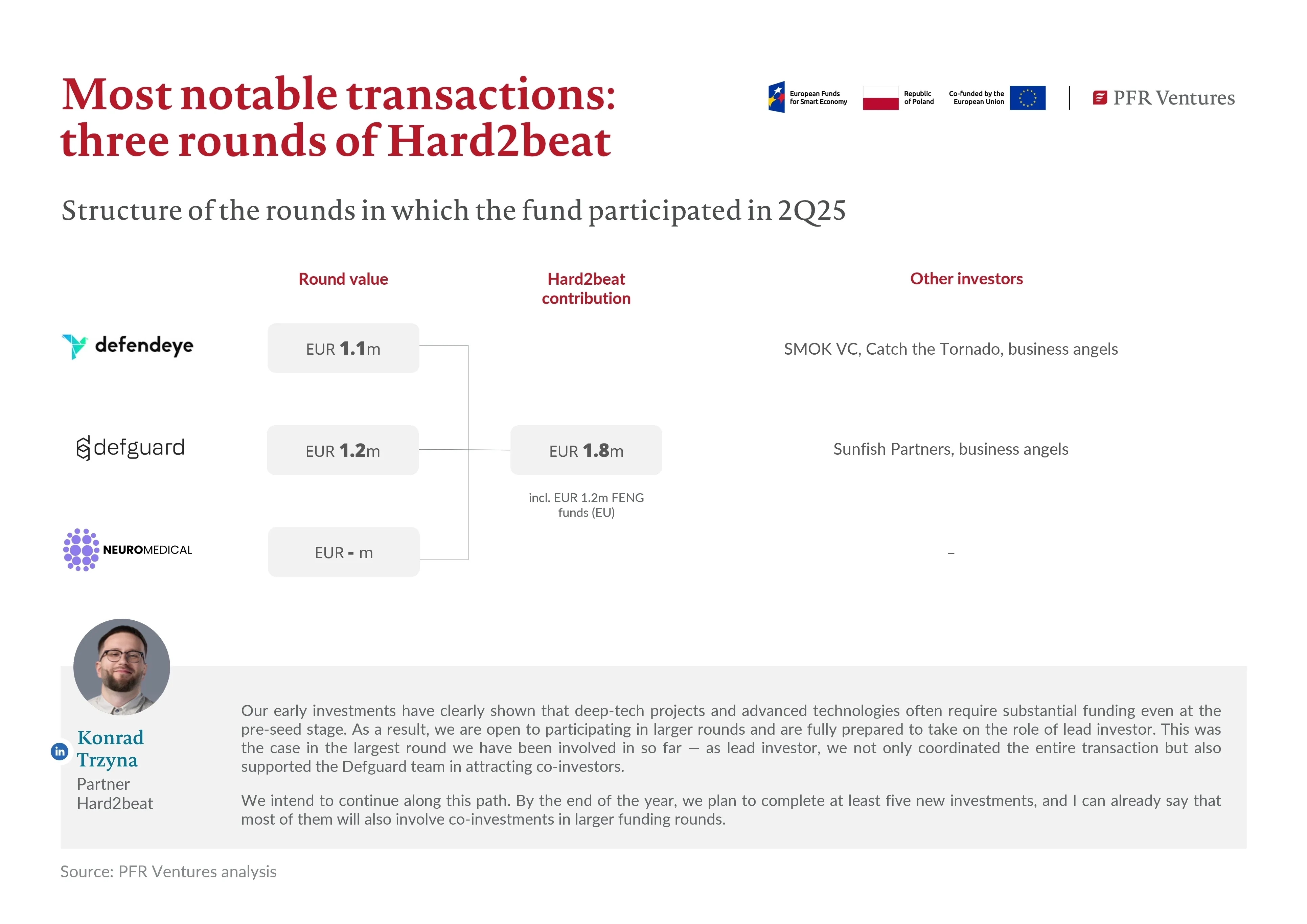

PFR Ventures and Inovo.vc have prepared a report summarising transactions on the Polish venture capital (VC) market in the second quarter of 2025. The data show that during this period, 48 companies raised PLN 549 million from 37 funds.