Polish VC market outlook Q3 2024

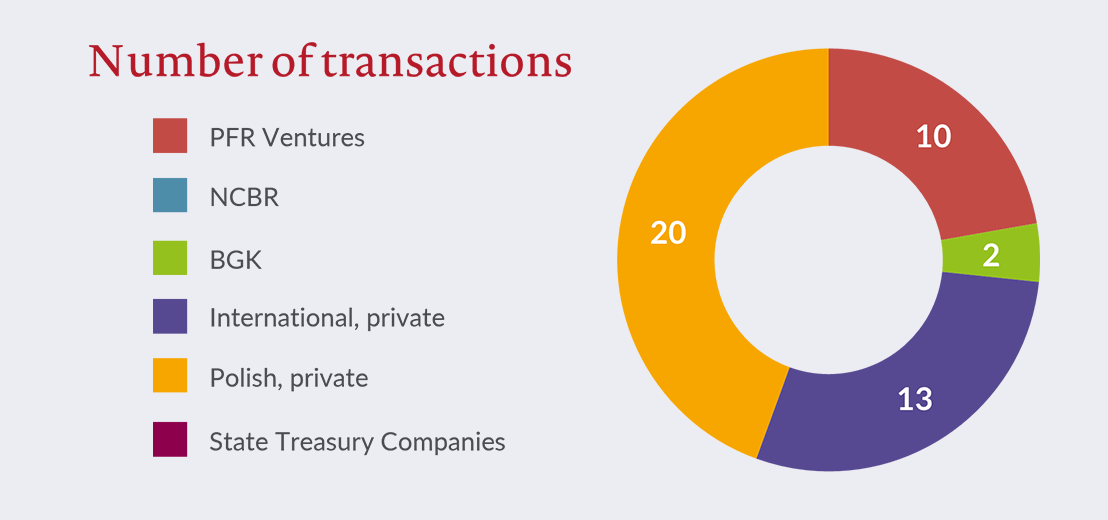

PFR Ventures and Inovo VC have published a report summarising activity in the Polish venture capital (VC) market for Q3 2024. The data shows that 45 companies raised a combined PLN 506 million from 60 funds in this period

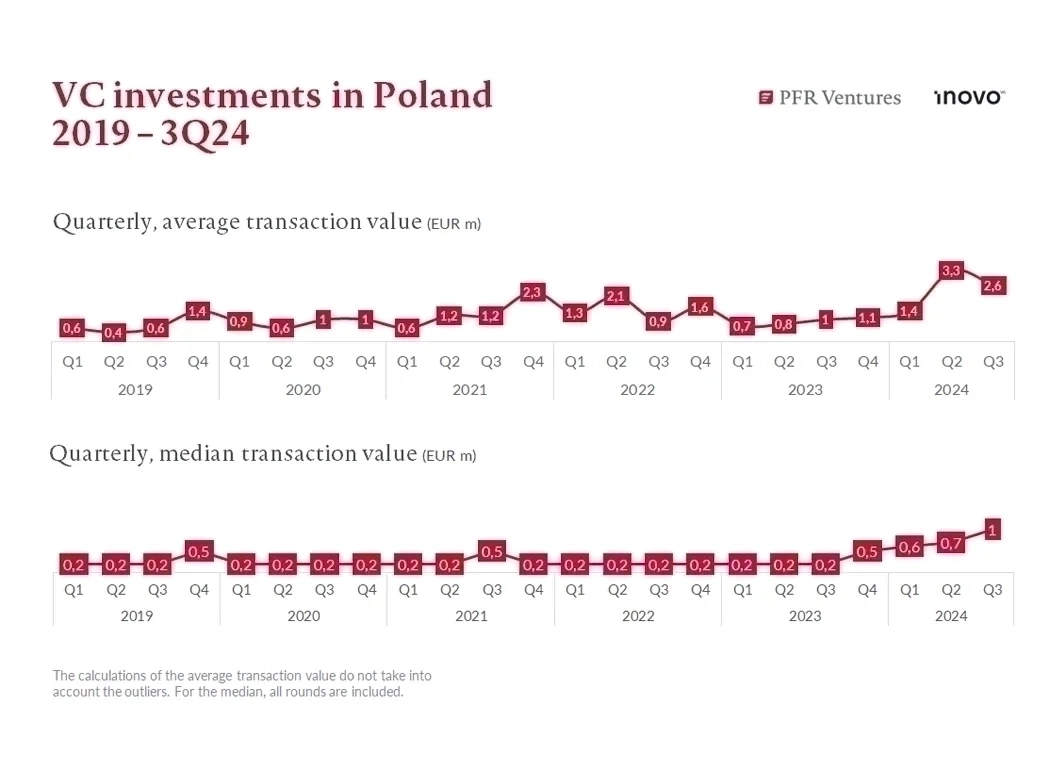

This capital flow of PLN 506 million represents the total invested by both Polish and international funds across 45 transactions involving innovative Polish enterprises. The average transaction value was PLN 11.2 million. Cumulative funding for 2024 has now reached PLN 1.5 billion.

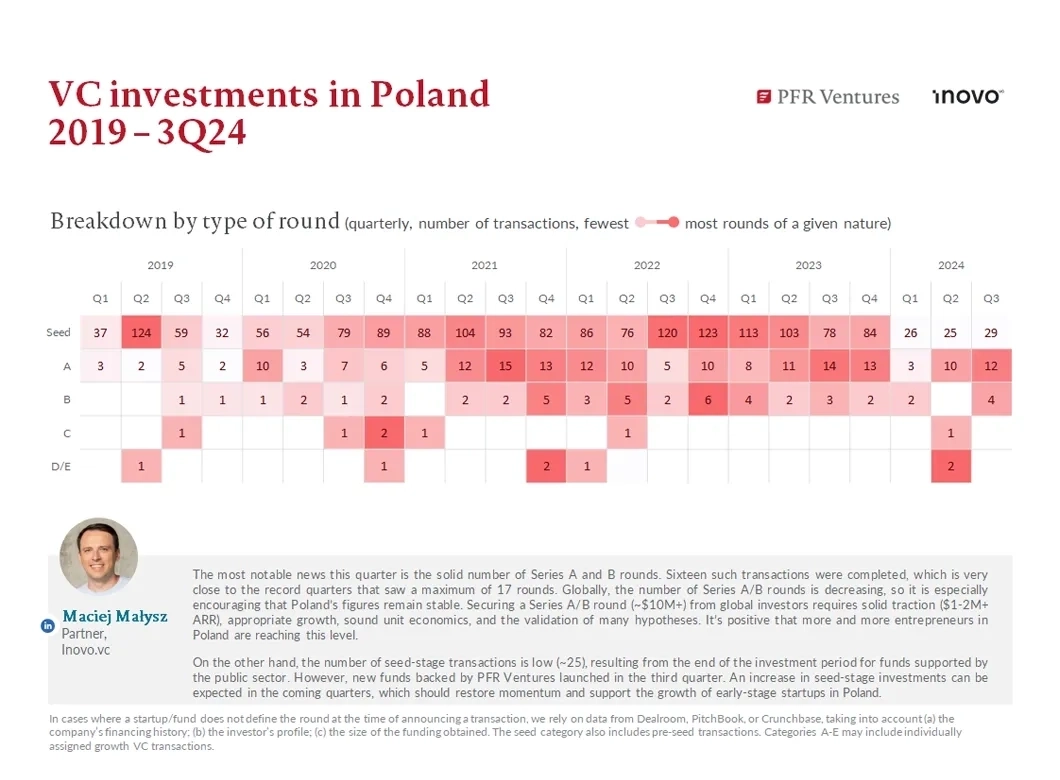

The trend of a low number of transactions continued into the third quarter. Although there was a modest improvement compared to the first quarter (nearly +50%), the result remains significantly below the statistics recorded in 2021-2023. By the end of September 2024, we recorded 80 seed rounds and 34 Series A+ transactions (with 16 of these occurring in the third quarter).