Polish VC Market Outlook 2025

PFR Ventures and Inovo VC have prepared a report summarising transactions on the Polish venture capital (VC) market in 2025. The data shows that, over this period, 166 companies raised EUR 0.8 billion from 147 funds.

In 2025, EUR 0.8 billion flowed through the Polish VC market. This is the total value of capital that Polish and international funds invested across 183 transactions in 166 domestic innovative enterprises. Comparing 2025 with 2024 and excluding so-called mega-rounds, the market value increased by 28%..

Among the largest transactions was ElevenLabs’ EUR 171 million round, which drew interest from international investors such as Andreessen Horowitz and ICONIQ Growth. Strong attention was also focused on ICEYE: the microsatellite manufacturer raised more than EUR 150 million in total, with investors including Vinci—an investment vehicle backed by Bank Gospodarstwa Krajowego. In the past year, Poland’s Ministry of National Defence also joined the recipients of this advanced technology, with ICEYE supplying the Polish Armed Forces with radar satellites under the MikroSAR programme.

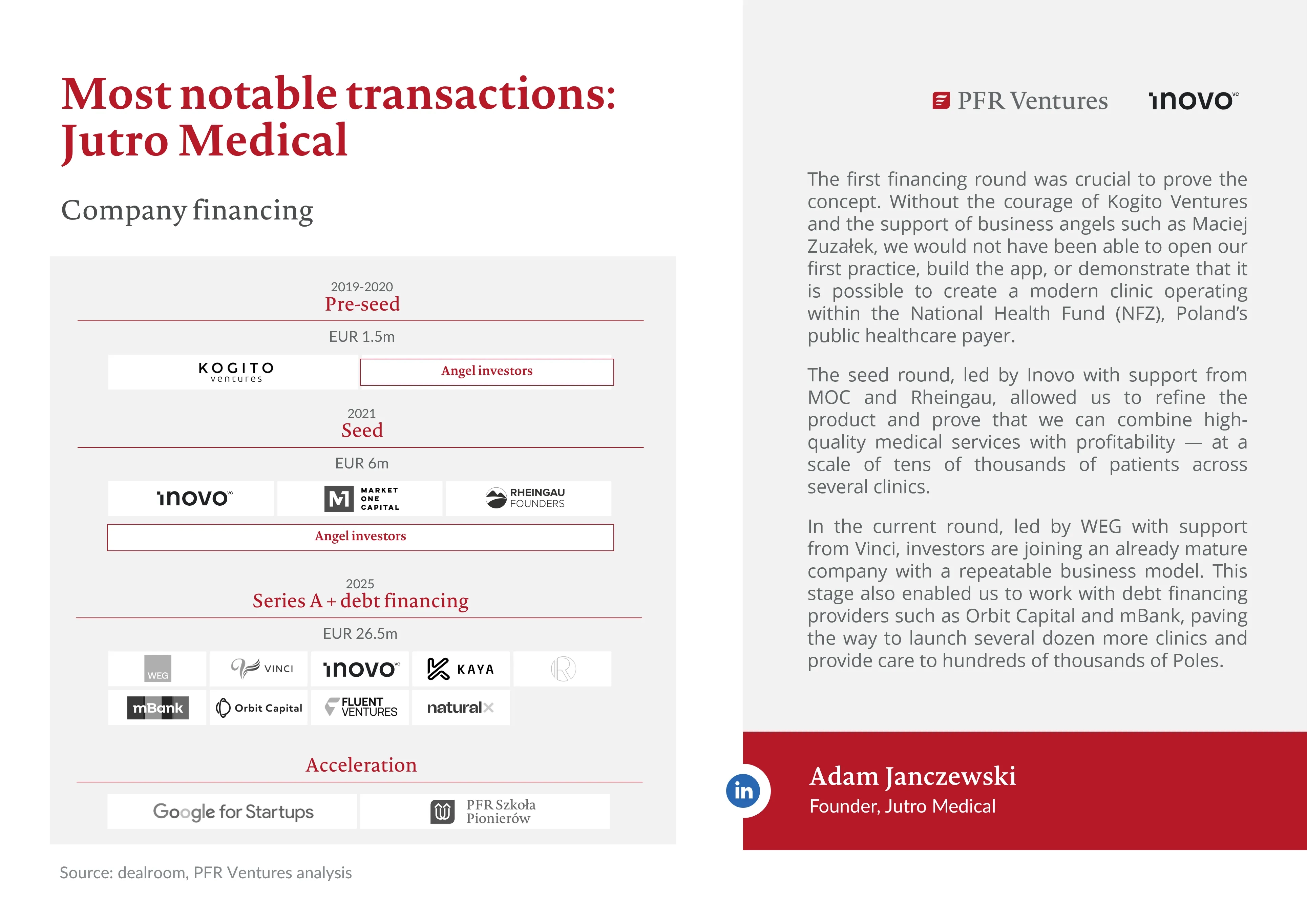

One of the largest transactions also involved Jutro Medical, whose earlier financing was provided, among others, by Kogito Ventures, Inovo VC, and Market One Capital.

Transaction details

In 2025, seed-stage investments dominated the Polish VC market, with 134 such transactions completed. This represents an increase of nearly 20% compared with the previous year, when 113 rounds of this type were recorded. At the same time, the average ticket size remained broadly unchanged at around EUR 1,5 million. This activity has been driven in part by a new cohort of funds capitalised with EU resources under the European Funds for a Modern Economy (FENG).

The Polish VC market also saw seven growth-stage investments. In more than half of these, bValue participated. Companies financed by the team included Xtreme Brands, Fudo Security, and Sportano.

Sources of capital

Out of the 183 identified transactions, 82 involved funds from the PFR Ventures portfolio. This means that the number of rounds funded with EU and PFR capital on the domestic market more than doubled year on year. Polish business angels (private individual investors) took part in half of all transactions completed in 2025. Meanwhile, rounds backed by international funds accounted for around 40% of the capital deployed in the market over the last 12 months

Sectors, business models, and employment

VC capital most often goes to companies innovating in healthcare—a trend that has held steady for six years. In 2025, these companies accounted for 13.1% of all completed transactions. The year also saw a particularly strong increase in biotechnology deals: PFR Ventures and Inovo VC identified 11 rounds of this type, with a total value exceeding EUR 20 million.

Many of the projects raising funding operate at the intersection of multiple sectors. Ingenix and QuireGen are examples. In the report, they are classified as advanced healthcare technology solutions that make significant use of AI.

The most popular business model remains SaaS (subscription-based).