Polish VC market outlook 2020

PFR Ventures, together with Inovo Venture Partners, has prepared an annual report summarizing transactions on the Polish venture capital (VC) market. The data shows that in the last year 158 funds financed 300 companies. They obtained ca. EUR 477 million from investors.

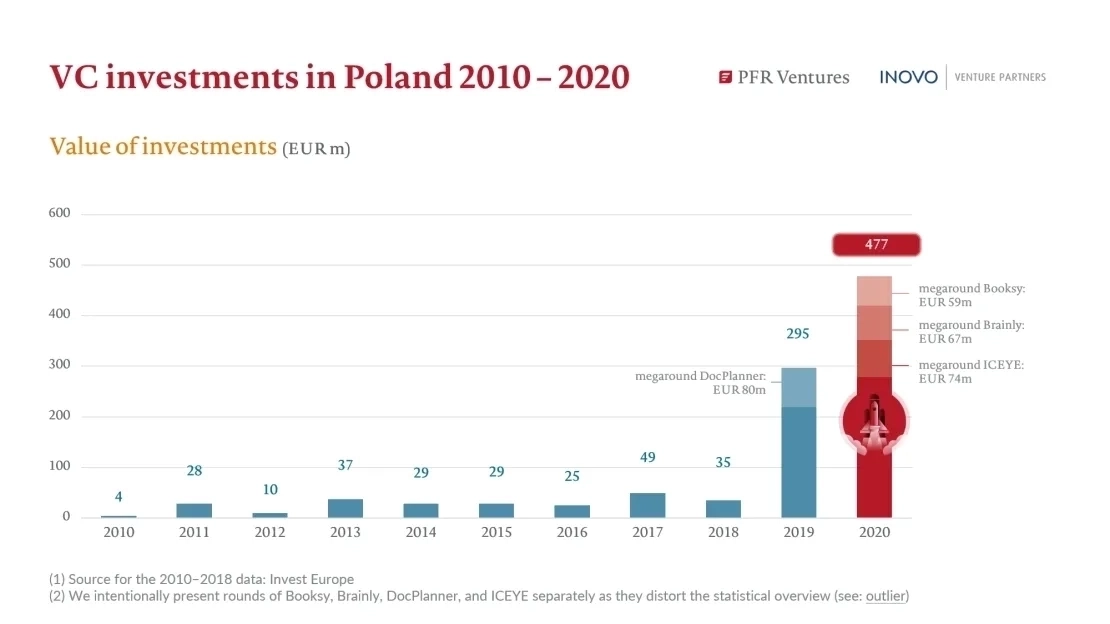

In 2020, EUR 477 million flowed through the Polish VC market. This is the total amount of capital that Polish and foreign funds have invested in innovative domestic companies. As compared to 2019, the value of investments increased by 70% YoY. The largest financing rounds included: ICEYE (EUR 74 million), Brainly (EUR 67 million) and Booksy (EUR 59 million).

Chart 1 Value of VC investment in EUR million

2020 marks the year in which we have reported another record on the Polish venture capital market. Three transactions in the range of EUR 60 to 80 million have created the main candidates trying to claim the title of becoming the first Polish unicorn. However, it does not mean that there will not be a 'dark horse' in 2021

– says Aleksander Mokrzycki, vice president at PFR Ventures

Despite the uncertain market environment, 2020 was undoubtedly the best year in the Polish startup scene. A 70% increase in the investment value compared to 2019, shows that both our local ecosystem and the overall tech sector play a significant role in the economy and are often resistant to the macroeconomic environment

– comments Tomasz Swieboda, partner at Inovo Venture Partners

62% of the financing was public-private capital, and the share of international funds in the total value of transactions was 48%. At the same time, 258 out of 310 transactions were based on public-private capital. 74 out of 310 transactions are investments with the participation of PFR Ventures funds. In 2020, they provided 28% of capital for innovative companies. The funds of the National Center for Research and Development, which carried out 146 transactions, played an important role in the seed segment.

The five largest financing rounds accounted for slightly more than half of the total value in 2020. At the same time, the average transaction value was growing, approaching EUR 1 million. The median remained at the level of EUR 0,2 million.

One out of four startups that has received VC funding is involved in developing innovations in the area of health. These are not only scientific ventures, but also ones ventures that aim to revolutionize the current system of healthcare or increase our awareness of the condition of loved ones. Solutions for corporations (Enterprise Software) and FinTech were also popular among investors. They accounted for 15% and 9% of all transactions in 2020, respectively.

Speaking of exits, it is worth noting the partial sale of the Booksy package by Inovo Venture Partners. According to the fund, the cash-on-cash (CoC) ratio for this transaction is over 10x.