Polish VC market activity in 1Q 21 summary

PFR Ventures, together with Inovo Venture Partners, has prepared a quarterly report summarizing transactions on the Polish venture capital (VC) market. The data shows that in the first quarter of 2021, 65 funds have invested in 93 companies. They raised ca. EUR 53 M from investors.

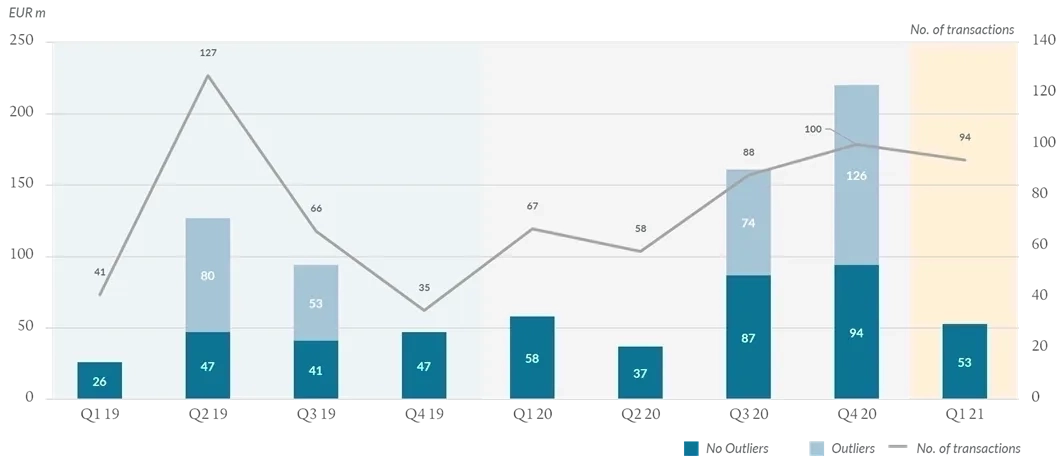

In Q1 2020, EUR53 million flowed through the Polish VC market. This is the total amount of capital that Polish and foreign funds have invested in innovative domestic companies. As compared to the first quarter of 2020, the value of investments dropped by merely 2.5, while the number of investment rounds increased by 40.3% YoY.

46% of the financing was public-private capital, and the share of international funds in the total value of transactions was 35%. At the same time, 73 out of 94 transactions were based on public-private capital. Polish venture capital funds participated in 84 financing rounds.

Aleksander Mokrzycki, vice president at PFR Ventures, said:

We recorded nearly 100 transactions in the first quarter of 2021. Looking at the historical data, this is a good opening of the new year. The value of capital delivered, comparing to the same period in 2020, remained at the same level.

Tomasz Swieboda, partner at Inovo Venture Partners, said:

In the first quarter of 2021, many young startups received capital in pre-Seed or Seed rounds. Some of them will obtain further, larger financing shortly, which will translate into increased value and strengthening of our ecosystem.

The funds of the National Center for Research and Development, which carried out 33 transactions, played an important role in the early-stage segment (pre-seed and seed). The fifteen largest financing rounds accounted for 59% of the total value in Q1 2021.

One of the most notable investments is the funding round of Airly. The cleantech business that provides actionable insights about air quality has raised EUR 2.7M from a collective of business angels that includes Bolt CEO Markus Villig, founding Editor-in-Chief of WIRED David Rowan Pipedrive founder Ragnar Sass and Sir Richard Branson’s Family Office. Poland’s venture capital market has also noted an exit with 5.3x ROI, as VC firm Innovation Nest sold its stake in e-commerce platform Picodi.