PFR Otwarte Innowacje

Fund profile

early stage, growth ? PFR OI funds invest in growing start-ups generating the first sales

Assets under management

PLN 442m

Commitment

from PLN 5m up to PLN 70m

Private commitment

Yes, min. 40% ? Beyond private investors, General Partners commiit their own capital to a fund

Investment period

4 years

Investment process

cyclical calls ? You can file an offer whener the recruitment is open.

About

The programme is dedicated for teams eager to manage VC funds focused on investments in to SMEs working on research and development projects

PFR Otwarte Innowacje is a program operating within the fund-of-funds model addressed to teams which want to manage a Venture Capital fund focusing on investments in technological projects, with a R&D component, which create technologies based on the open innovation formula.

The program involves investing in venture capital funds, whose investment ticket in technological companies amounts to up to PLN 5 million up to 15% of the investment budget. Throughout the fund period, managers receive a management fee as well as carried interest after the fund has been settled.

It is allowed to adopt both the standard structure of the fund and the co-investment model in which private investors are selected on a deal-by-deal basis (they do not invest through the fund structure but directly together with the fund in portfolio companies).

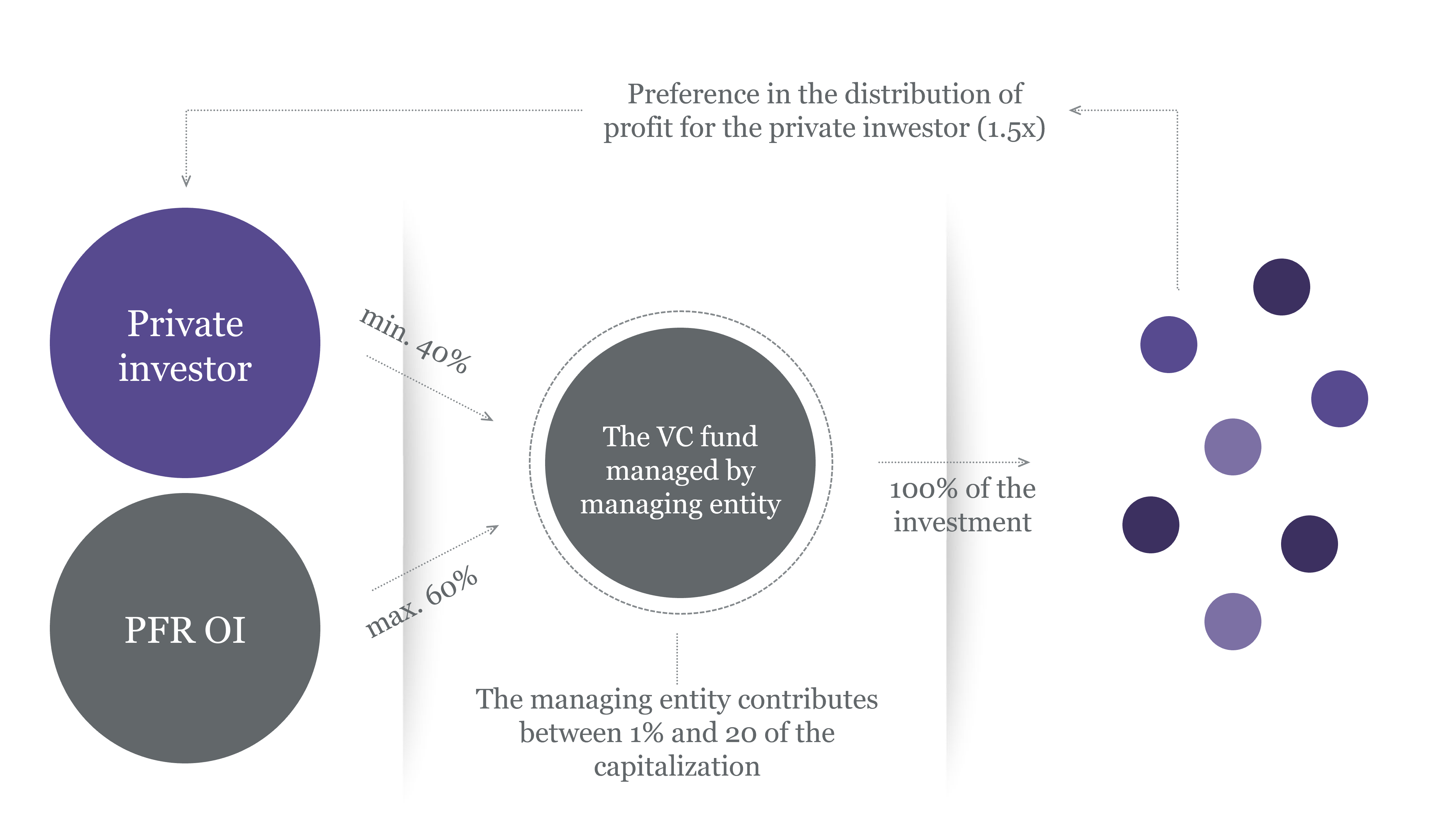

Standard structure:

- Contribution of PFR OI (between PLN 45 and PLN 80 million) on the fund level, but not more than 60% of the fund capitalization.

- Private contribution: min. 40% of the capitalization (including 1-20% from the managing entity).

- Fund capitalization: from PLN 75 million

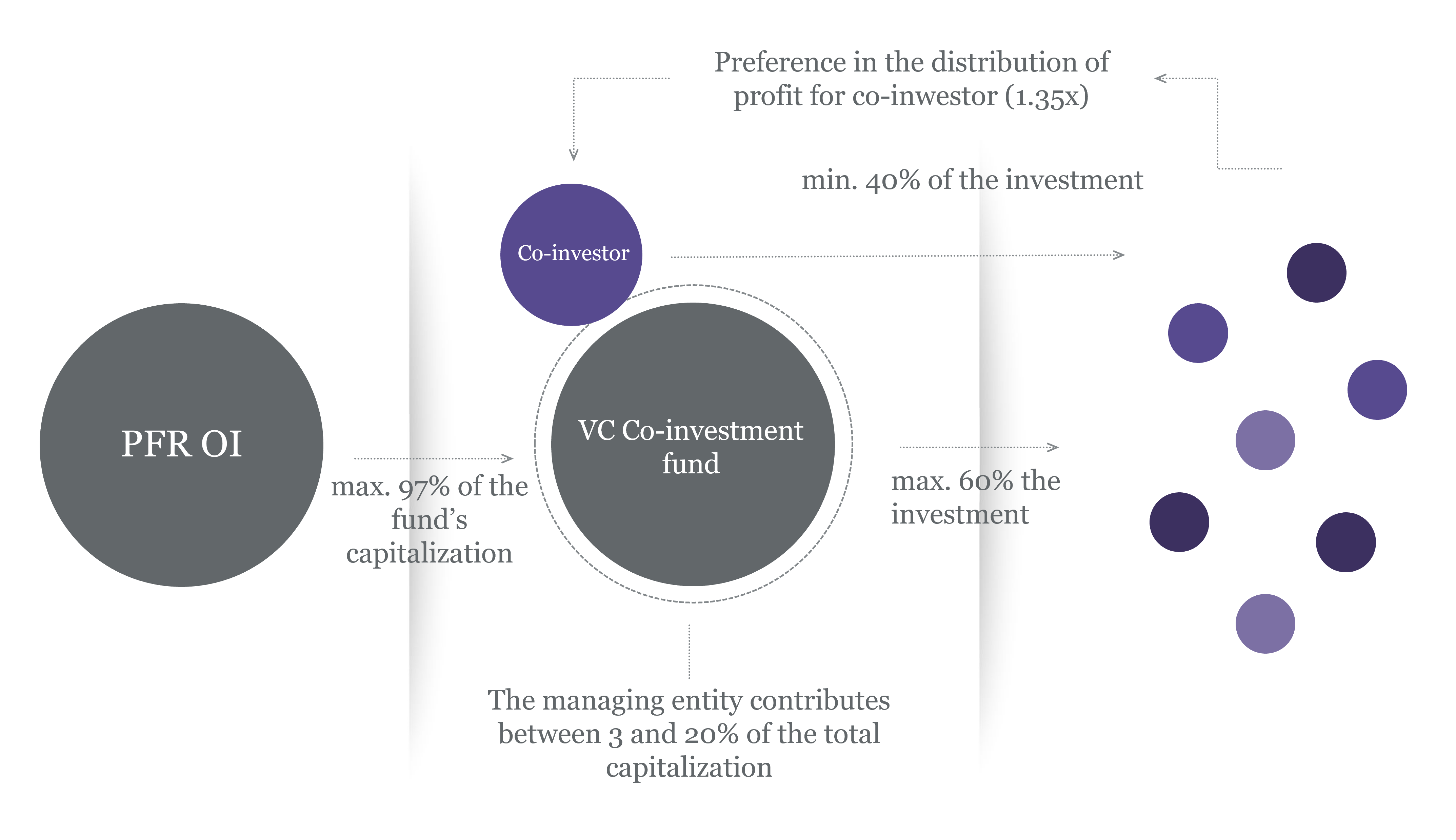

Co-investment model:

- Contribution of PFR OI (between PLN 45 and PLN 80 million) on the fund level, but not more than maximum 97% of the fund capitalization.

- Contribution of the managing entity: 3-20% of the fund capitalization.

- Private contribution on the level of investments in portfolio companies: minimum 40% (a managing entity is responsible for acquiring private investors on a deal-by-deal basis).

- Fund capitalization: from PLN 46 million

Assets

Do you have any questions?

If you want to know more, please contact us.

Pozostałe produkty:

No results for chosen filters.

Try to clear filters or change search criteria.