PFR Starter

Fund profile

incubation, start ? funds under PFR Starter management invest in companies at an early-stage of development

Assets under management

PLN 807m

Commitment

up to PLN 5m ? The maximum amount that can be invested by a fund established under PFR Starter.

Private commitment

Yes, min. 20% ? Beyond private investors, General Partners commiit their own capital to a fund

Investment period

4 years

Investment process

cyclical calls ? You can file an offer whener the call is open

About

Dedicated to management teams who desire to support innovative companies in early stage of growth.

PFR Starter as one of nine programmes operating under the fund-of-funds formula within PFR Ventures. It is aimed at funds investing primarily in companies at the earliest stage of development (before the first commercial sale). The programme assumes investments in venture capital funds with an investment ticket of up to PLN 5 million.

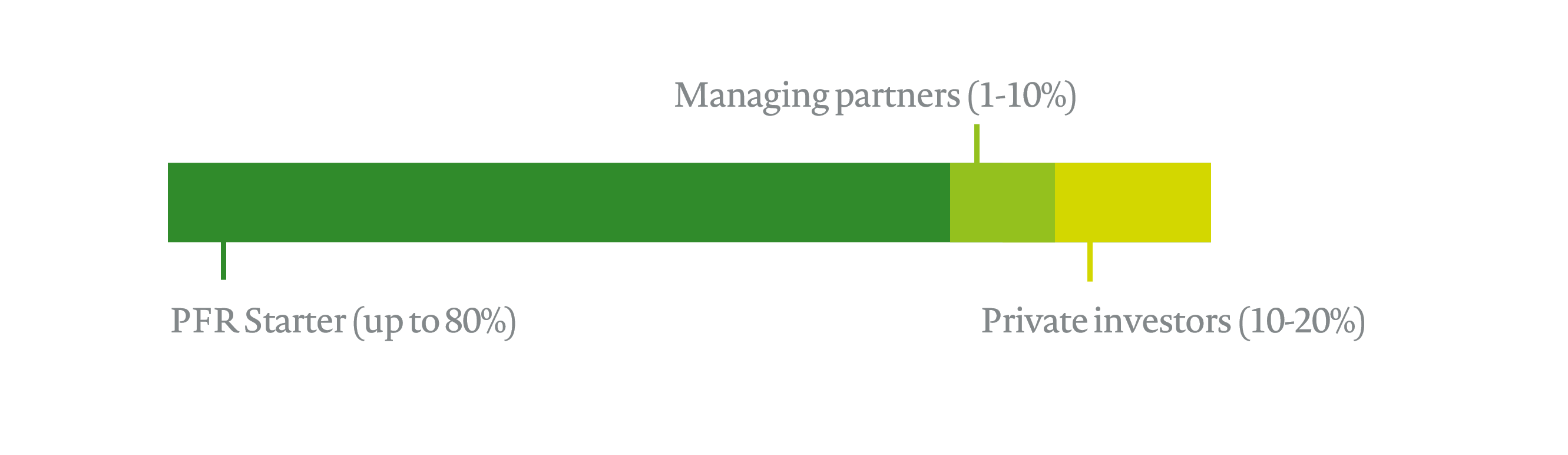

PFR Starter's share in the capitalisation of the fund is a maximum of 80% (PLN 20-65 million) - the remaining part is contributed by members of the investment team and independent private investors with the right to 2.5 times the profit asymmetry in relation to their share in the capitalisation of the fund.

The investment period provided for under the programme is 4 years. The disinvestment period is a further 4 years. Throughout the life of the fund, the managers receive a management fee and, upon settlement of the fund, a carried interest.

The aim of the programme is to develop an ecosystem of innovations and start-ups by creating professional teams managing VC funds - the funds with which we cooperate in Starter are selected in the course of calls, in which we pay special attention to the complementary experience (investment / entrepreneurial / industry) of people forming the team and the orientation of a given team towards innovative start-ups, together with readiness to actively support them and engage in fund management.

Assets

Do you have any questions?

If you want to know more, please contact us.

Pozostałe produkty:

No results for chosen filters.

Try to clear filters or change search criteria.